S.No

|

Parameter Name

|

Data

|

Rating

|

Remarks

%

|

1

|

Gross Profit Margin

|

2008--41%

2009--27%

2010--39%

2011--31%

2012--32%

|

3

|

Gross profit margin is healthy.It is more than 30%.It went below in

2009 as there was a forex exchange loss of 176Cr in that year

|

2

|

Operating Profit Margin

|

2008--16%

2009--5%

2010--20%

2011--10%

2012--13%

|

2

|

Operating margin is above 10% , in 2009 it went down due to forex

loss.

Operating Margin is much less compares to other IT majors like Infosys ,

TCS.Infosys operates at 35% , TCS at 28-29%.The main reason for this

difference is that this company has different pricing policy.Billing rates

are less compared to Biggies whereas the employee cost and other expenses

remain in same ratio.

Billing rates in some cases are less than 20-30% from big players like Infosys

, TCS

|

3

|

Net Profit Margin

|

2008--14%

2009--2%

2010--16%

2011--8%

2012--11%

|

3

|

Net profit has improved in last year.In Q1 Fy13 it was 15% and in Q2

Fy13 it was 12%.

Company is recovering from bad times.Quarterly results are now more

predictable.

|

4

|

Selling , General and Admin expenses

|

2008--35%

2009--47%

2010--26%

2011--36%

2012--27%

|

3

|

SGA expenses are under limit with less 30% of Gross Profit.

In 2009 it went up due to forex loss.

|

5

|

Depreciation %

|

2008--11%

2009--16%

2010--12%

2011--14%

2012--11%

|

2

|

Depreciation cost is little on a higher side and computers, softwares

and leases taking the major depreciation cost.

|

6

|

Interest %

|

2008--5%

2009--37%

2010--2%

2011--4%

2012--0%

|

5

|

Company is essentially debt free.It has loans of 137Cr in 2009 which

has now reduced to 40cr.

|

7

|

Net Profit growth rate for past years

|

2008--104.18 Growth -71%

2009--30.01 Growth 593%

2010--208.10 Growth -40%

2011--123.10 Growth 77%

2012--218.70

|

2

|

Net profit growth rate is not encouraging, in 2009 forex loss of

176Cr.2010 was better with forex gain of 70cr which shot up the profit.In

2011 , forex gain was 15cr compared to 70cr in previous year. 2012 was

good.Q1 and Q2 of 2013 are good and if the dollar remains in range of 54-55

then Q3 can show some good amount of improvement

|

8

|

EPS growth rate for past years

|

2008--27.47 Growth -71%

2009--7.90 Growth 566%

2010--52.66 Growth -41%

2011--30.75 Growth 75%

2012--53.94

|

2

|

EPS growth has also not been encouraging due to above reasons

|

9

|

Dividend History

|

2008--20.00%

2009--10.00%

2010--30.00%

2011--25.00%

2012--40.00%

|

3

|

Dividend is consistent but yield is .5%

|

10

|

Inventory

|

2008--0.00 Growth 0%

2009--0.00 Growth 0%

2010--0.00 Growth 0%

2011--0.00 Growth 0%

2012--0.00

|

|

Not applicable for this company

|

11

|

Business , Advantage and Quality of Management

|

Business is to provide IT solutions to clients.Main tasks are

application development , maintenance and support.Company has 2 segments :IT

services and Product Engineering.IT services business has 65% share and PE

has 35% share.

IT services business is growing well and is main driver of growth.PE business

is facing challenges and it more or less stagnant.

|

3

|

Mindtree has good management team.Subroto Bagchi Co-founder and

chairman.He is a well known public figure.

Krishnakumar -KK is the CEO,MD and co-founder with more than 30 years of

experience in IT industry.KK is also the Vice Chairman of NASSCOM.

Overall the management team looks good.

|

12

|

Current ratio

|

2008--2.5

2009--1.43

2010--1.6

2011--2.55

2012--2.24

|

4

|

Current ratio looks comfortable well above 1

|

13

|

Debt to Equity

|

2008--0.17

2009--0.26

2010--0

2011--0.01

2012--0.05

|

4

|

Debt free company having surplus cash.As per Q2 fy13 , company has 438

cr as cash with 331cr invested in mutual funds.Company has equity of 1100Cr

as per Q2 Fy13 so cash is in healthy state

|

14

|

Debt/Earnings

|

2008--0.88

2009--4.64

2010--0.01

2011--0.04

2012--0.2

|

|

it is nearly debt free company now so very low debt/ earnings

|

15

|

Is the Company generating free cash flow? Capital Expenditure?

|

Capex

2009-- -18.87

2010-- 115.84

2011-- 291.45

2012-- 51.1

|

4

|

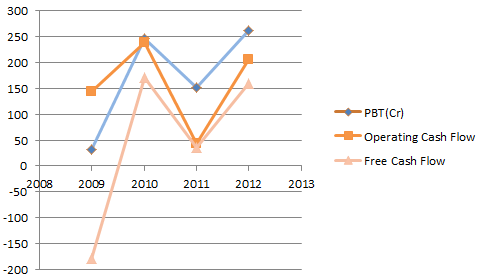

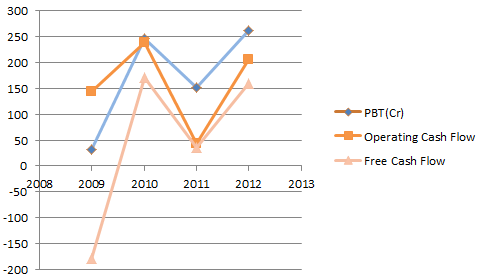

Company is generating good amount of free cash flow.Operating cash

flow looks good in comparison to EBITA , refer to below graph.

Free cash flow has been positive and in good amount for last 4 years except

for 2009 in which Mindtree acquired Aztecsoft for 291 cr, pune based

company.Mindtree holds around 80% stake in Aztecsoft.

|

16

|

Return on Equity & Return on assets

|

Return on Equity

2008--19%

2009--5%

2010--32%

2011--15%

2012--22%

Return on Assets

2008--16%

2009--4%

2010--32%

2011--15%

2012--21%

|

3

|

Return on equity and return on assets are around 20% which is average

|

17

|

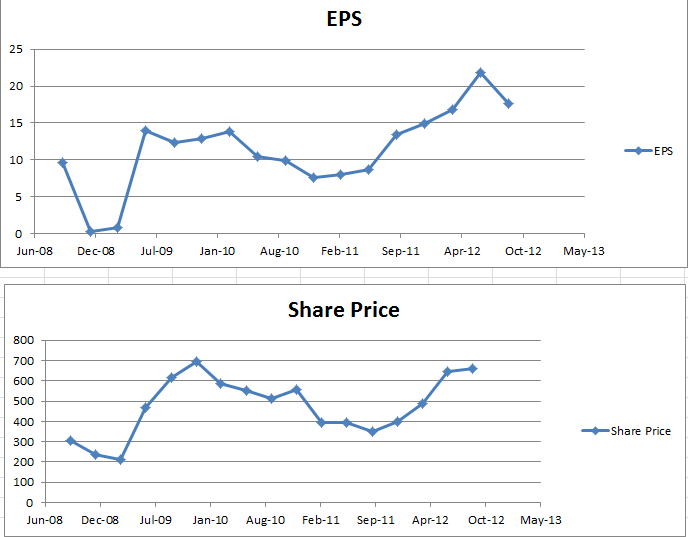

graph of stock price

|

Graph of stock has not been great as there are lot of variations in

the earnings.

It is strictly following earnings.When earnings are good then price is on

high and earnings are bad such as in 2011 then price has declined , refer to

attached graph.From Aug 2011 the graph is on uptrend as earnings are

increasing consistently

|

3

|

|

18

|

retained earning growth rate and its use

|

2008--496.05 Growth 0%

2009--492.36 Growth 23%

2010--606.48 Growth 21%

2011--736.40 Growth 24%

2012--917.10

|

4

|

Retained earning has been growing at a good rate.Retained earnings are

being mainly used for acquisitions , investment in mutual funds and expansion

of gross block.

In 2009 , Aztecsoft was acquired for 291 Cr.In Oct 2009 , it acquired Kyocera

Wireless for 43 Cr.Some part of the money was used for leasing , buildings ,

software etc.

In last 2 years extra cash was used to invest in mutual funds .Company has

around 438Cr in cash and cash equivalents as of Q2 Fy13.

|

19

|

P/E ratio

|

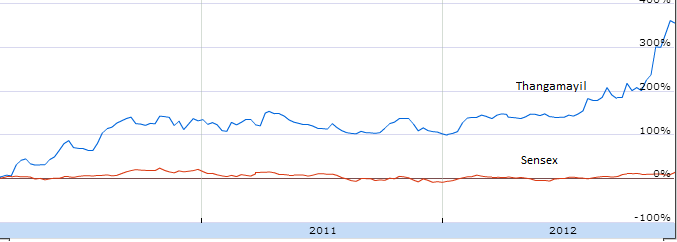

Mindtree has a p/E ratio of 10 as of nov 2012 , which is at discount

compared to peers.

Big Players

Infosys - 14

TCS- 20

HCL - 19

Mid Size companies:

Hexaware -10

Geometric - 9

|

3

|

So PE of mindtree stands at 9-10 which seems to be justified as the

company is mid sized and period from 2008-2010 has not been very encouraging.

Company business is much more predictable now , if it shows 3-4 quarters with

same performance as Q1 and Q2 of Fy13 then P/E can be upgraded to 12-13

|

20

|

intangile assests , brand value and does a company have advantage over

others

|

Mindtree has a strong brand value in mid sized IT space.

The one advantage company has is lower pricing.

|

4

|

As indicated in point 22 , IT business has now become more or less

commodity business , lower pricing can be a boon for the company

|

21

|

are insiders buying the stocks , is company buying back shares , are

mfs holding this company

|

Company's Stock is held by more than 20 mutual funds and some of them

have upped their stake in Q2 Fy13.

|

4

|

Siddartha , founder of CCD has increased his stake from 17.79 to 21.26

in June 2012.He bought at a average price of 610 Rs in june 2012.

Foreign institutional investors are heavily invested in the company and now

FII investment limit has reached.

http://www.business-standard.com/india/news/fii-investment-in-mindtree-hits-trigger-limit-rbi/179540/on

|

22

|

Growth type of company and room for expansion

Impact of Industry parameters and Government policies

|

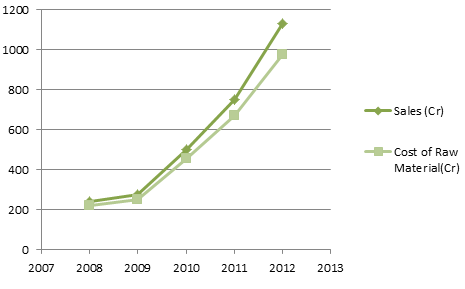

Mindtree is a mid sized company with revenue of 1900 Cr FY12.

The company is in growth stage.

Revenue for big players are in range of 20000-30000cr so it still has lot of

room to expand.

|

|

The whole IT industry has now become very competitive in last 4-5

years in which all players like Infosys, TCS , Wipro , Mindtree are providing

same types of services like software development , maintenance, application

migrations.IT service industry

has now behaving like a commodity business in which none of the company have

advantage over others.

In the whole story , time may be right for small IT companies as their

pricing it 20-30% lower than the big players.This is where companies like

mindtree, hexaware might click in.

|

23

|

do you understand business , do you have edge in this industry,what do

you know which market does not know

|

Neutral on this point as IT industry is the one of the most tracked

industry in stock market.Most of the fundamentals and business developments

are already factored in the stock price

|

3

|

One thing to note here.

Big client generally work with more than 1 IT provider.

Now Mindtree is also working with other IT players to support client's IT

needs and in some cases Mindree share is increasing due to lower pricing and

also due to change in strategy of the company to focus on big players.This

can go in favour of the company

|

24

|

Competition

|

Infosys:

OP Margin - 35% , PE- 14 , Sales 31000Cr.

TCS:

OP Margin -27, PE -20 , Sales -38000Cr

Mid Sized IT companies:

Hexaware:

NP Margin - 18%, PE - 10 , Sales - 1450 Cr.

Persistent:

NP Margin -14% , PE -12 , Sales - 1000Cr

Mindtree:

NP Margin - 11% , PE - 10, Sales -1900cr

|

3

|

Mindtree is a small sized IT company so it makes sense to compare it

with companies like Persistent , Hexaware instead of Infosys,TCS.

Mindtree is a well managed mid sized IT company.

Currently almost all big players are operating in range of 25-35% of OP

Margin and Mid Sized companies at 12-18%.

Mindtree seems to have no competitive advantage over its competitors.

|

25

|

what company does ,your story on company , why do you think that

company will become better than what it is today, or any other point

|

Mindtree is a mid sized IT company.Company faced some challenges in

past and now it is recovering.

It has created a new brand entity by changing its logo.Company is now

focusing on big client.Number of clients which were below 1 million USD in

revenue has been reduced significantly, number of 20$ mn client are now 4

from 2 in q2 fy12.Share from top 5 client is increasing which shows

increasing faith of big clients in the company

|

4

|

Concerns:

Company is impacted by dollar vs rupee alot.It posted a loss of 176Cr in

2009.It had forex loss of 41cr in Q2 fy13

Not getting big deals:Mindtree

has to do lot of work before it can start getting big deals.It has just 4

clients which off more than 20$ mn revenue.

Mindtree currently has pricing advantage, it has lower billing rates compared

to big players but it could be in problem once big payers starts lowering

billing rates to avoid losing clients.

Mindtree look strong in mid cap IT space.Its quarterly results are much more

predictable now.If the company can keep 3-4 quarters with positive growth

then stock can demand P/E of 12-14.

Long term story of the company looks promising.

Company can give 15-20% return annually over next few years if growth

momentum continues

|