S.No

|

Parameter Name

|

Data

|

Rating

|

Remarks

%

|

1

|

Gross Profit Margin

|

2008--6%

2009--9%

2010--9%

2011--10%

2012--12%

|

3

|

Gross profit Margin

have been consistent , we can see higher margin in 2010 to 2012 due to rising

gold prices.

Due to increase in gold prices ,company could see its finished products at

higher prices.Gross profit margin in this industry are very low as cost if

raw material is generally more than 85% of the sales.It is the nature of

jewellery business

|

2

|

Operating Profit

Margin

|

2008--5%

2009--7%

2010--6%

2011--8%

2012--10%

|

3

|

OP Margin are more

or less consistent.

Operating margin has increased in last 2 years due to same reason as above

|

3

|

Net Profit Margin

|

2008--3%

2009--3%

2010--3%

2011--4%

2012--5%

|

3

|

Consistent and Net

Profit margin has also increased due to rising gold procies.But it should be

noted here that gross , operating and net profit margin are dependent on gold

prices.There is some degree of risk involved here

|

4

|

Selling , General and

Admin expenses

|

2008--11%

2009--15%

2010--21%

2011--15%

2012--14%

|

4

|

SGA expenses are

under control.

They are well under 30% of gross profit so it is fine.

|

5

|

Depreciation %

|

2008--2%

2009--2%

2010--2%

2011--2%

2012--1%

|

4

|

Depreciation cost is

consistent over years and it is well under 7-8% of gross profit

|

6

|

Interest %

|

2008--15%

2009--25%

2010--21%

2011--17%

2012--24%

|

2

|

Company has lot of

debt which is used mainly for working capital and here it is mainly for

purchasing gold.Some amount of debt is also used for opening more stores but

this expense is small compared to utilization in working capital.Company has

to pay interest on this debt and this interest payment is much above 15%.

|

7

|

Net Profit growth rate

for past years

|

2008--6.86 Growth

29%

2009--8.88 Growth 80%

2010--16.07 Growth 94%

2011--31.33 Growth 88%

2012--59.06

|

4

|

Net Profit growth

has been exceptional.Number of stores has increased from 2 in 2008 to 23 in

nov 2012.

Net Profit has been growing at a average rate of 70% for last 5 years

|

8

|

EPS growth rate for past

years

|

2008--7.91 Growth

23%

2009--9.80 Growth 19%

2010--11.71 Growth 95%

2011--22.84 Growth 88%

2012--43.05

|

5

|

EPS has been growing

at average rate of more than 50% for last 5 years

|

9

|

Dividend History

|

2008--5.00%

2009--10.00%

2010--40.00%

2011--50.00%

2012--70.00%

|

4

|

Company has been

paying dividend regularly.

Moreover the dividend yield is also good , in oct 2012 it was around 3.14%

|

10

|

Inventory

|

2008--35.60 Growth

80%

2009--64.30 Growth 81%

2010--116.78 Growth 77%

2011--207.75 Growth 77%

2012--369.23

|

3

|

Inventory growth is

inline with sales and net profit.Inventory has also been increasing as

company is opening new stores.In this case inventory is gold which has got

real value and moreover this value is increasing by time so inventory is fine

here.

One risk could be that if there is sharp decline in gold prices then it can

impact profitability of the company and can lead to exception loss to the

company

|

11

|

Business , Advantage

and Quality of Management

|

Management of the

company is moving in right direction , more and more stores are being added

timely.Company is using ERP for stores and inventory management and also to

manage its financials.

Management is open in reporting concerns which are present in business.For

e.g risk of commodity , risk due to other big competitors are being openly

taken in the annual reports.Company is also planning to open its online

shopping store and it should be ready by 2012 year end

|

4

|

References

-http://www.thehindubusinessline.com/companies/jewellery-industry-witnessing-polarisation-says-thangamayil-jmd/article3750247.ece

Annual report - fy11 - page 31 to 35

|

12

|

Current ratio

|

2008--7.63

2009--6.84

2010--12.27

2011--9.09

2012--7.23

|

4

|

Current ratio is

well above 1

|

13

|

Debt to Equity

|

2008--0.7

2009--1.31

2010--0.93

2011--1.37

2012--1.85

|

2

|

Debt to equity ratio

has been increasing , it is mainly due to opening more and more stores and

also for purchasing gold for these new stores.Company is in expansion

mode.

But debt to equity ratio is still a matter of concern.

|

14

|

Debt/Earnings

|

2008--2.95

2009--4.89

2010--4.36

2011--4.29

2012--4.58

|

3

|

Debt/earnings

indicates that company has good earning power and it is able to pay off its

loans.

|

15

|

Is the Company

generating free cash flow? Capital Expenditure?

|

Capex

2009-- 25

2010-- 62.55

2011-- 87.66

2012-- 179.29

|

3

|

Company is not

generating free cash flow , FCF has been negative for last few years.Below

are the numbers:

Operating cash flow :

2010 : -34Cr

2011: -36Cr

2012 :-67

FCF

2010: -39Cr

2011: -48

2012 : -106

But most of this money has been used to increase inventory i.e to provide

gold to its stores.For e.g in 2011 90 cr of inventory was added , in 2012 52

Cr of inventory is added.

It should be fine in this case as inventory which is gold is very liquid and

its market value is equal or more than what is stated on balance sheet.In

future when number of stores are constant then FCF and OCF should be positive

and increasing yoy.We need to watch this parameter in future

|

16

|

Return on Equity &

Return on assets

|

Return on

Equity

2008--23%

2009--26%

2010--21%

2011--31%

2012--40%

Return on Assets

2008--13%

2009--11%

2010--11%

2011--13%

2012--14%

|

3

|

Return on equity is

good.

one reason for having ROE higher has normal is that company is using lot of

debt which is making ROE higher.

|

17

|

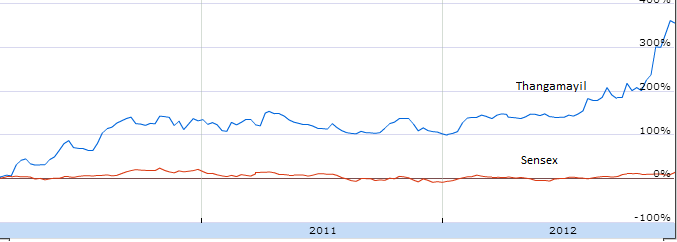

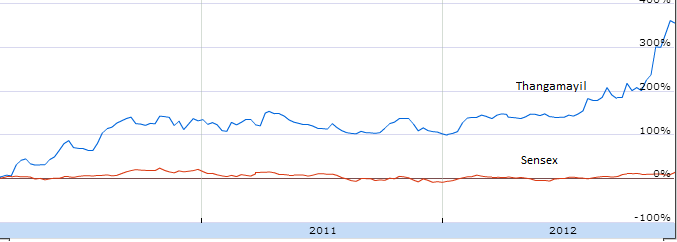

graph of stock price

|

Company got listed

in 2010.

Since then stock price has been on upward trend.It was in range of 180 till

oct 2012 but after that it has made a good run .This run is mainly due to good

results in june and September and also that more and more people are now

become aware of the company.

|

4

|

Volume was normally

in range of 4000 -5000 earlier but in oct -nov 2012 it is in range of

20000-30000.

|

18

|

retained earning

growth rate and its use

|

2008--14.24 Growth

68%

2009--23.96 Growth 155%

2010--61.15 Growth 38%

2011--84.49 Growth 56%

2012--132.39

|

4

|

Retained earning

growth is impressive and retained earnings are mainly used for expansion of

new stores as well as purchasing gold for these stores.

|

19

|

P/E ratio

|

P/E ratio in Nov

2012 - 8.5

Sep 2012 - 5

Jan 2012 - 4

|

5

|

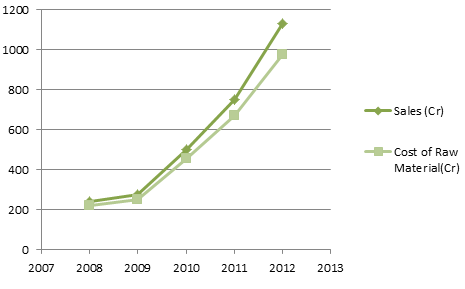

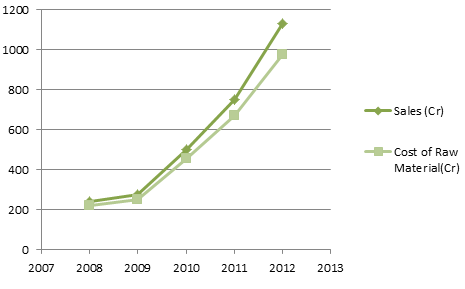

Company sales have

been growing at more than 50% for last 5 years.Net profit has been growing at

more than 60% for last 4 years.

Thangamayil is small cap company with market capitalization of 450Cr in nov

2012.

The company has good potential and it can add more stores which are

profitable then stock price can go higher.

|

20

|

intangile assests ,

brand value and does a company have advantage over others

|

Thangamayil has good

brand image in cities of Tamil Nadu.

As per company current plan , it wants to cover Tamil Nadu first and then

move to other states.

|

4

|

Company is more

focused on rural urban and semi urban areas and it is a popular brand among

people.

It is very difficult to build a brand image in big cities.

Company plan is to first capture market in small cities and then ride on it

brand image to big cities.

|

21

|

are insiders buying

the stocks , is company buying back shares , are mfs holding this company

|

Promoters believe in

the growth story of the company and have been buying companys shares.

|

4

|

promoters holding is

increased from 68.81% in june 2012 to 69.23 % in Sep 12

|

22

|

Growth type of company

and room for expansion

Impact of Industry parameters and Government policies

|

Company is in growth

stage.

It is mainly operating in Tamil Nadu and can add stores in nearby stores. So

next few years are good for expansion.

|

4

|

Company is adding

more and more stores.It has 23 stores as of nov 2012 and the plan is to have

28 stores by march 2013.

|

23

|

do you understand

business , do you have edge in this industry,what do you know which market

does not know

|

The business is

simple.

Purchase raw gold , create jewelery and sell in stores.

There is nothing complex about the business.The concern of fluctuation in

gold prices is there.The other concern is that it is operating in Tamil Nadu

and it has proved itself there.It may also grown in nearby states but its

products will be tested in middle and northern parts of India as people have

wear different style of jewellery there

|

4

|

The big positive

with the stock of this company is that it is not tracked by mutual funds and

other big players.

Once the company becomes popular among biggies then stick price can take a

real jump from here and it can reach P/E of 14-15 where other average

jewellery companies operate

|

24

|

Competition

|

Big players :

Titan: Sales - 8900Cr ,NP margin - 6%, D/E - 0, P/E - 40

Tribhovandas Sales - 1385 Cr, NP margin - 4% , D/E - 1.28 , P/E

(nov 2012) -28.

Gitanjali Gems Sales - 12498 Cr, NP - 4%, D/E - 1.3 , P/E - 9.5

Among all players in the country , Titan is the market leader with strong

brand images.It is nearly a debt free company which is a rare sight in this

industry

|

3

|

Local Players

Madurai has seen the entry of Alukkas Jewellers, Bhima Jewellers andKalyan

Jewellers,

Lalitha Jewellers, Kirthilal jewellery and themajority of themhavepresence in

15 to 20 other cities.

Such new entrants come inwith the financialmuscle that comes out ofmanaging

10 – 15 outlets and

hence have the ability to spend heavily on advertising and on maintaining

higher levels of

inventory.

Similar entryby other players inMadurai aswell as other locations targeted by

Thangamayil could

make businessdifficult andaffect profitability inthe long run.

|

25

|

what company does

,your story on company , why do you think that company will become better

than what it is today, or any other point

|

As of nov 2012 ,

company has 23 stores , giving revenue of about 1350 Cr (last 4 quarters) ,

NP margin is 5% , Net profit - .4*1350 = 67.5Cr.

It has plans to have 28 stores by March 2013.

|

5

|

Company is on expansion mode and it has added 7 Brand in this year.

Company is on expansion mode and it has added 7 Brand in this year.

If we assume that it adds 5 branches each year for next 5 years then revenue

could be in range of 3000Cr , with current margin Profit could become 150

Cr.Assuming PE of 15 as company will have more brand awareness after 5 years

then market cap could become 2250Cr.Market Cap in nov 2012 is 450Cr.So

potential upside is 2250/450 = 5 times.

So if all is well then in 5 years the stock has potential to become 5 times

in coming 5 years

|

Stock looks really cheap , it should touch 400 after Q3 results

ReplyDelete